Is National Securities Depository IPO Good or Bad – Detailed Review

00:00 / 00:00

National Securities Depository Limited (NSDL) is bringing its Initial Public Offering (IPO) between 30 July 2025 and 1 August 2025. Before investing in this IPO, many investors must have this question in their mind: is the National Securities Depository IPO good or bad? That is, will it be a wise move to invest in it?

In this article, we will understand the National Securities Depository IPO review in detail which will discuss the company's business model, financial analysis, industry positioning and return potential so that you can make an informed investment decision.

NSDL IPO Review

NSDL Limited's IPO is opening from 30 July and will close on 1 August 2025. It is India's first and largest depository company, which provides facilities to hold shares and other securities in electronic form. The company was founded in 1996 and today NSDL's network is spread across the country, which includes more than 2.8 crore investors and more than 2,98,000 active Demat accounts.

NSDL's business is mainly based on electronic depository services, which allows it to keep equity, debentures, mutual funds and bonds safe in digital form. Apart from this, NSDL also provides PAN application, National Pension System (NPS), e-KYC and other digital services.

Due to the rapidly growing capital market and digital financial inclusion in India, NSDL's business model is considered sustainable and future-ready. The company's revenue model comes from transactions and annual issuer charges, which creates a stable recurring income base.

Talking about financial performance, the company recorded a revenue of Rs.934 crore and a net profit of Rs.234 crore in FY23, which reflects stable growth compared to previous years. The company's EBITDA margin is strong and RoE has also been impressive as per industry standards.

The NSDL IPO is raising around Rs.1,300 crore, of which Rs.500 crore is a fresh issue and the rest is an Offer for Sale (OFS). The objective of this IPO is to enhance the brand visibility of the company and support future expansion. The price band is set at Rs.275 to Rs.291 per share and the expected date of listing is August 6, 2025.

The company's strengths include: regulatory support, long-term operational history, technological infrastructure, and a steadily growing user base. However, some risk factors such as competition, regulatory dependency and limited diversification also exist.

Company Overview of NSDL IPO

NSDL Limited is the country's first and largest depository that provides the facility to hold securities in electronic form. Started in 1996, NSDL today has a strong presence across India.

The company's services are not limited to electronic holding of equity, debentures, mutual funds and bonds, but also include PAN application, National Pension System (NPS), e-KYC, and many other digital services. NSDL's network today is spread across the country and includes more than 2.8 crore investors and around 2,98,000 Active Demat accounts.

Robust Infrastructure and Digital Innovation :

NSDL's technological infrastructure is very strong and secure. It has high-level data security protocols that keep investors' data completely safe. NSDL's system is integrated with various financial institutions such as banks, mutual funds, and stock brokers, making seamless transactions and verification possible.

Stable Revenue Model and Reliable Financial Performance :

The company's revenue comes primarily from transaction charges and annual issuer fees, which maintains recurring income. In FY23, NSDL reported revenue of Rs.934 crore and net profit of Rs.234 crore. EBITDA margins are also strong as per industry standards and Return on Equity (RoE) has also remained consistently good.

Regulatory Support and Industry Leadership :

NSDL is regulated by the Securities and Exchange Board of India (SEBI), which further enhances its credibility and trustworthiness. The company acts as a trusted medium between investors, government bodies, and institutions.

In today's digital age where financial inclusion and paperless transactions are increasing, the role and importance of NSDL is constantly increasing. A strong client base, tech-enabled services and predictable revenue model make it a long-term growth company.

Industry Overview of NSDL IPO

With the establishment of NSDL in 1996, India moved away from physical share certificates to electronic demat systems. This move brought a revolutionary change in the Indian capital market, where investors earlier had to face fraud, delays and paperwork in ownership due to physical certificates. NSDL made the entire process paperless, fast and secure.

Current State of the Depository Industry :

There are currently only two major depositories in India – NSDL (National Securities Depository Ltd.) and CDSL (Central Depository Services Ltd.). Although CDSL has a higher number of demat accounts, NSDL leads in high value and institutional investor holdings. As of March 2025, NSDL had custody of 3.97 crore+ depository accounts, with a total value of over Rs.510.91 lakh crore making it a high-value custodian.

Rapid increase in retail investment :

Since COVID-19, there has been a huge jump in the number of retail investors in India. New demat accounts have been opened in crores between FY21 and FY25. The boom of the IPO market, increasing investment in mutual funds and awareness of youth towards equity markets are responsible for this. Institutions like NSDL are getting direct growth opportunities from this.

Impact of Digital India and regulatory changes :

The Digital India initiative of SEBI and the government has brought tremendous growth in the depository sector. Facilities like E-KYC, UPI based IPO applications and completely digital onboarding have made opening a demat account and investing extremely easy. This has given NSDL an increase in customer base from both retail and institutional.

Depository Penetration still low :

Only 17% of the people have a demat account so far against India's population of about 140 crores. This means that the sector still has a long and strong growth potential. As people adopt investing in mutual funds, ETFs and equities, companies like NSDL will directly benefit from this.

Future Prospects and Industry Growth Projection :

According to industry reports, the number of demat account holders in India may cross 10 crores in the next 5 years. Also, factors such as the growing trend of ETFs and passive investing, PSU disinvestment by the government and the IPO pipeline may take the depository sector to new heights. NSDL with its long experience and technological capabilities is well-positioned to efficiently manage this growth.

Financial Overview of NSDL IPO

Particulars | March 31, 2025 (Rs crore) | March 31, 2024 (Rs crore) | March 31, 2023 (Rs crore) |

Assets | 2,984.84 | 2,257.74 | 2,093.48 |

Revenue | 1,535.19 | 1,365.71 | 1,099.81 |

Profit After Tax | 343.12 | 275.45 | 234.81 |

EBITDA | 492.94 | 381.13 | 328.60 |

Net Worth | 2,005.34 | 1,684.10 | 1,428.86 |

Reserves and Surplus | 232.31 | 216.32 | 199.08 |

NSDL has shown consistent strength in its earnings over the last three years. The company's income was Rs.1,099.81 crore in FY23, which increased to Rs.1,365.71 crore in FY24 and reached Rs.1,535.19 crore in FY25. This trend shows that the demand for demat accounts and digital investment services in India is increasing rapidly, giving the company continuous benefits.

Tremendous increase in profits :

The company's net profit (Profit After Tax) has also increased steadily upwards. It was Rs.234.81 crore in FY23, which reached Rs.275.45 crore in FY24 and Rs.343.12 crore in FY25. This jump shows that NSDL is not only increasing its operational efficiency but is also adopting a smart strategy in cost management.

Strength in EBITDA and improved operating margin :

NSDL's EBITDA was Rs.328.60 crore in FY23, which increased to Rs.381.13 crore in FY24 and Rs.492.94 crore in FY25. This increase in EBITDA indicates the company's core business strength and stable operational performance. This means that the company is earning good profits from its main operations.

Strength in balance sheet and jump in net worth :

The company's total assets were Rs.2,093.48 crore in FY23, which increased to Rs.2,257.74 crore in FY24 and Rs.2,984.84 crore in FY25. Similarly, the company's net worth has increased from Rs.1,428.86 crore in FY23 to Rs.2,005.34 crore in FY25. This clearly shows that the company's balance sheet is not only solid but also ready for growth in the long term.

Increasing reserves and financial stability :

The company had reserves and surplus of Rs.232.31 crore in FY25, which was Rs.199.08 crore in FY23. This increase shows that the company has been successful in creating a strong financial backup for its earnings. Also, due to the low debt of the company, its financial risk profile is also quite low risk.

Strengths and Risks of NSDL IPO

Strengths

1. Industry Leadership in Depository Services : NSDL is India's first and oldest depository, established in 1996. As of March 2025, NSDL has deposited securities worth over Rs.325 lakh crore, making it the country's leading depository.

2. Strong customer base and network : As of March 2025, NSDL has over 3.4 crore active depository accounts, connected through a network of over 2,00,000 service centers/DPs across the country. This network contributes rapidly to financial inclusion and investor access.

3. Strong financial performance : The company has a strong financial track record. While the company's PAT was Rs.234.81 crore in FY23, it increased to Rs.275.45 crore in FY24 and Rs.343.12 crore in FY25. Similarly, revenue has also grown for three consecutive years from Rs.1,099.81 crore in FY23 to Rs.1,535.19 crore in FY25.

4. Technology-Driven Platform : NSDL has made its systems completely digital and automated. Innovation and automation in services like e-Voting, PAN Verification, e-KYC have significantly increased the operational efficiency of the company.

5. Regulatory Backing and Trust : NSDL is licensed by major regulatory bodies like SEBI and RBI. This reflects regulatory trust and confidence in transparency, which reassures investors.

Risks

1. Regulatory Dependence : NSDL's operations are based on SEBI, RBI and other regulatory guidelines. Any regulatory changes can affect the company's business model and revenue structure.

2. Competition from CDSL & New Entrants : Although NSDL is the market leader, it faces tough competition from other depositories like CDSL. Also, the arrival of fintech companies and blockchain-based solutions can increase competition even more.

3. Concentration of Business in Indian Capital Market : NSDL's entire operation is dependent on the Indian capital market. If there is a major decline in the domestic market or the interest of investors decreases, it can have a direct impact on the company's income.

4. Technology Risks & Cybersecurity Threats : Being a digital platform, the company is exposed to the risks of cyber attacks and technical failures. Data breach or system failure can affect both the company's image and operations.

5. Limited Global Diversification : NSDL's entire focus is on the Indian market. Its expansion internationally is limited, which makes it safe from global risks, but it may also deprive it of growth opportunities.

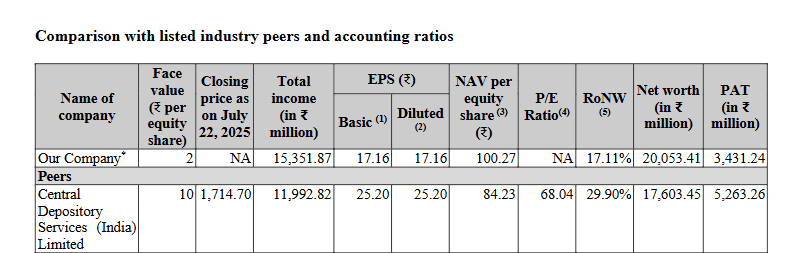

NSDL IPO vs. Peers

When it comes to comparing India’s two largest depository companies NSDL and CDSL the numbers speak for themselves. Both have similar models, but their operational and financial results point in slightly different directions.

Revenue : As per data till 2024, NSDL reported a total income of Rs.15,351.87 million, which is much higher than CDSL’s Rs.11,992.82 million. This shows that NSDL’s operational scale and business reach are still larger than CDSL’s.

Earnings per Share (EPS) : Although NSDL leads in revenue, CDSL leads in terms of EPS. CDSL’s EPS is Rs.25.20, while NSDL’s EPS was Rs.17.16. This means that CDSL's profitability per share is better - that is, equity holders are getting more earnings.

Net Worth and Returns : NSDL also has a bigger net worth - Rs.20,053.41 million versus CDSL's Rs.17,603.45 million. But just having a bigger net worth is not enough. If we look at RoNW i.e. Return on Net Worth, CDSL is far ahead of NSDL (17.11%) with an impressive return of 29.90%. This clearly shows that CDSL is using its capital more effectively.

Valuation (PE Ratio) : Since NSDL is not listed yet, its PE Ratio is not fixed. But CDSL's PE Ratio is 68.04, which reflects its stable growth and investor trust in the industry.

Objectives of NSDL IPO

This IPO of NSDL is not just to raise capital, but through this there is a plan to further strengthen the strategic position of the company. The main objective of this issue is:

To give exit opportunity to existing shareholders :

This IPO is completely an Offer for Sale (OFS), in which the company is not raising any new funds. This means that the existing shareholders of NSDL such as IDBI Bank, National Stock Exchange (NSE), State Bank of India (SBI), Union Bank of India, and HDFC Bank will sell some of their stake through this public issue.

Increasing liquidity and visibility by listing on BSE :

NSDL shares will be listed on BSE. Listing will not only bring liquidity to the shares, but will also increase the company's brand value, investor confidence and visibility in the market. This can facilitate NSDL to raise capital in the future.

Improve corporate governance and transparency :

As a listed company, NSDL has to follow strict regulatory and disclosure norms of SEBI. This will increase the transparency of the company and set an example of good corporate governance.

NSDL IPO Details

IPO Dates

NSDL IPO will be open for subscription from July 30, 2025, to August 1, 2025. The allotment of shares to investors will take place on August 4, 2025, and the company is expected to be listed on August 6,2025 on the BSE.

IPO Issue Price

NSDL is offering its shares in the price band of Rs 760 to Rs 800 per share. This means you would require an investment of Rs 14,400 per lot (18 shares) if you are bidding for the IPO at the upper price band.

IPO Size

NSDL is issuing a total of 5,01,45,001 shares, which are worth Rs 4,011.60 Cr.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on August 4, 2025, through the registrar's website, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of NSDL will be listed on the BSE on August 6, 2025.

Particulars | Details |

IPO Opening Date | July 30, 2025 |

IPO Closing Date | August 1, 2025 |

Price Band | Rs.760 to Rs.800 per share |

Lot Size | 18 Shares |

Issue Size | 5,01,45,001 shares (aggregating up to Rs 4,011.60 Cr) |

Face Value | Rs.2 per share |

Type of Issue | Bookbuilding IPO |

Tentative Allotment | Aug 4, 2025 |

Refunds Initiation | Aug 5, 2025 |

Shares Credited to Demat | Aug 5, 2025 |

Tentative Listing Date | Aug 6, 2025 |

Listing At | BSE |

NSDL IPO DRHP & RHP |

All Category