Step-by-Step Guide to Applying for an IPO Online with Rupeezy (AsthaTrade)

00:00 / 00:00

What Is IPO?

When a company registers itself for the first time to sell its shares and raise funds, it enters the primary market also known as Initial Public Offering (IPO) .

This is also called getting listed in a stock exchange. Once it gets listed in public domain on any exchange (NSE, BSE) people can trade.

Thanks to the technological advancement now anyone can apply for IPO online from phone sitting at home.

An IPO is a process by means of which a company can raise fund for its future expansion.

The general public will subscribe to the shares by paying a certain price. Businesses require funds for a variety of reasons.

This could be for expansion of their capacity (manufacturing units or new production site setup) or looking at diversification into new business lines.

Some companies may be looking at expanding their presence across India and abroad.

All these funding requirements can be met through an IPO. For this purpose Company need to go through several procedures.

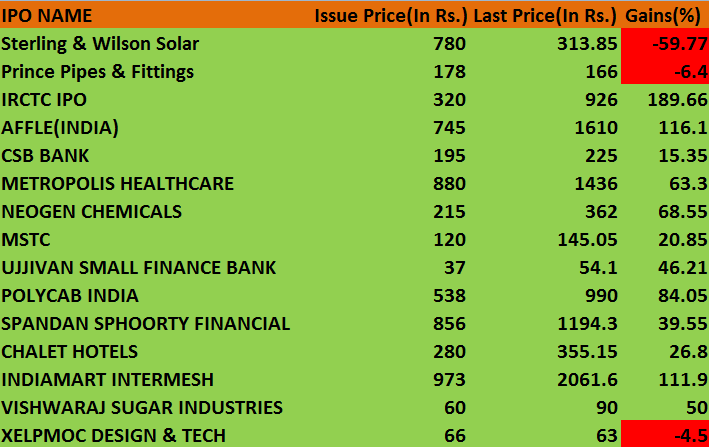

In the year 2019, there are number of IPO’S launched, below are few mainstream IPO’s launched last year:

Why should you buy IPO shares?

As you can see in the image above the astonishing returns within couple of days, who does not want it. You can double even triple your investment if you choose to apply for IPO.

However you need to be careful about the company you are applying. For that you need as an investors look at the fundamentals of the company before applying.

As a shareholder, you may get dividends, bonus shares, etc. based on the profit the company earns and based on its discretion.

Hence, we should correctly identify the opportunities by which we can make our money grow.

Investing in equity that is buying shares of the company is one of the best ways by which you can plan to achieve your long term goals.

IPO Online Complete Process

Today, we will be learning how you as a trader with Asthatrade can apply for IPO online directly through our website.

We are also happy for our clients as now no need to go to your bank asking to apply for IPO’s. All you need to have a demat account & you can apply for IPO online.

Those traders who do not have a demat account with us can still apply by entering their respective DPID and Beneficiary Id.

We will be understanding each and every step on how to apply for IPO online in this blogs. So without further wait let’s get started.

How To Apply For Upcoming IPO’s Online?

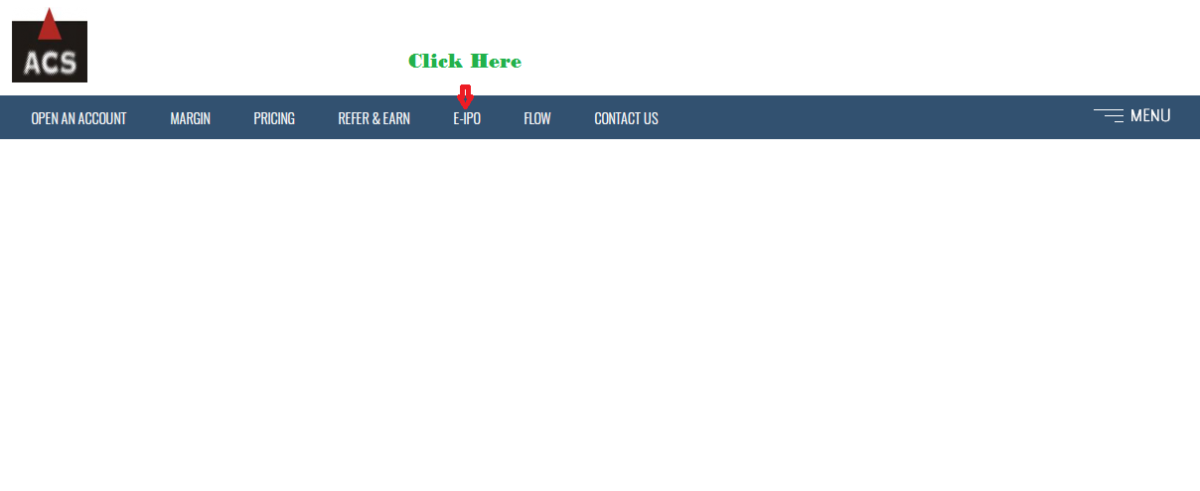

1. Visit our website rupeezy.in on your browser. Click on the option says E-IPO.

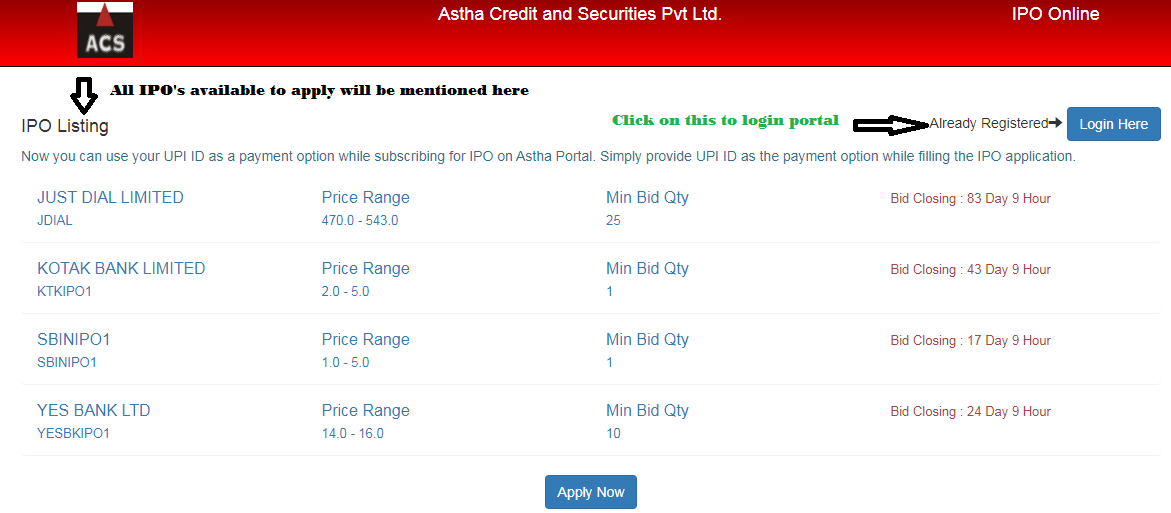

2. A new Page will appear, you need to login in portal also all the upcoming IPO’s details with name will be listed on the screen.

If you click on view details you can find all information about the IPO like (Market lot, Min. Price Range, Min Bid Quantity etc).

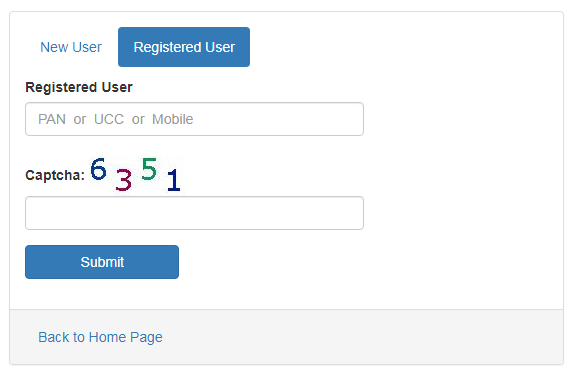

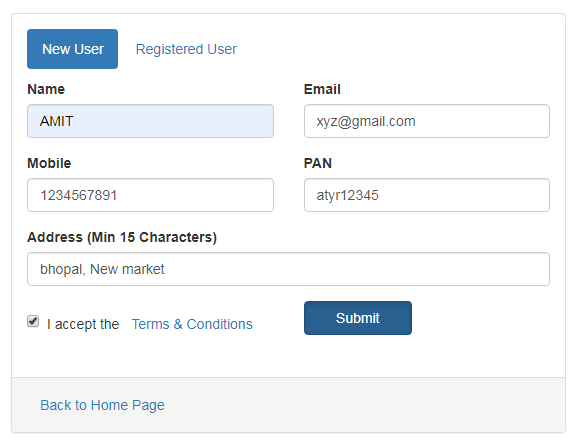

3. Once you click on login, There will be two options available , for new registration and for the registered user.

Please keep in mind all the clients who have an active account with Rupeezy can login directly by clicking on registered user.

You just need to enter your PANCARD, Client ID or Registered Mobile number with captcha showing on the screen.

4. For New Users, who don’t have an account with us can also apply. Just click on New user tab and enter the details.

Once you entered the details you will be receiving the OTP on your mobile. Enter the otp and you will get logged in to the portal directly.

A client ID will be sent to you for for the next time you want to apply.

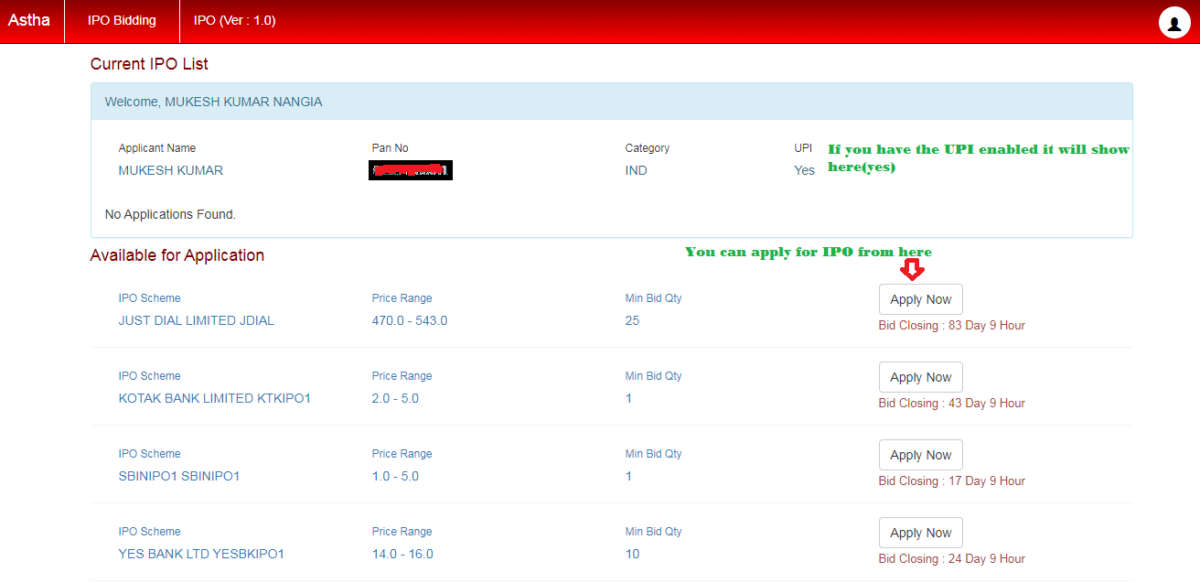

5. Once you are logged in to portal, you can find all your details like your name, PAN details, UPI .

You should make sure this UPI ID is mapped to your personal bank account. Now you can easily apply from the listed IPO’s from here. Click on one which you want to apply.

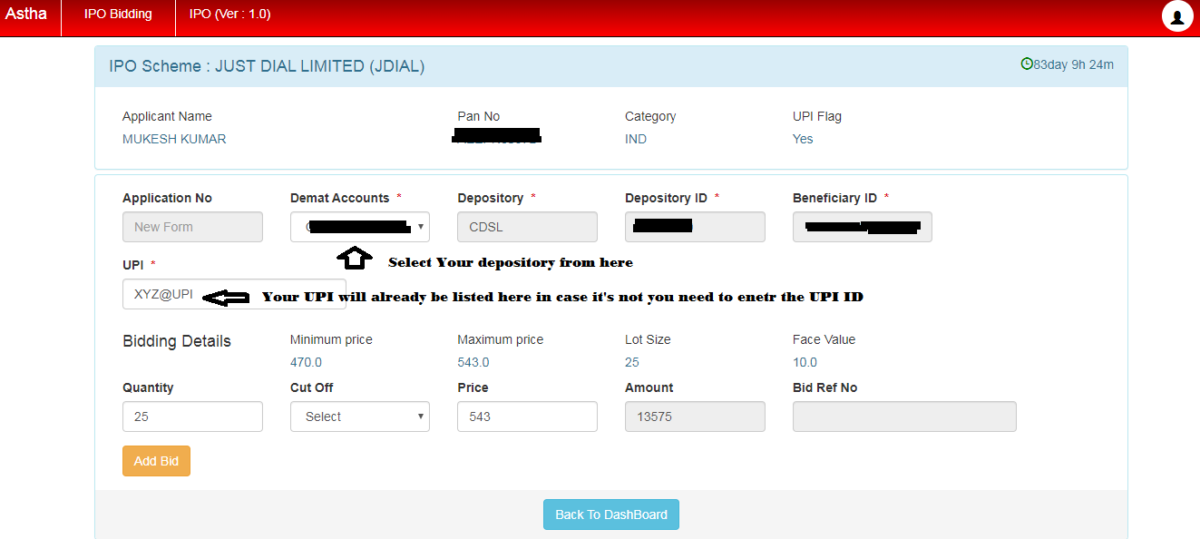

6. Once you click on any IPO’s listed you will be redirected to a new page, showing you couple of option. However you only need to select option under demat accounts.

Clients with Rupeezy can choose NSDL as there depository other options will automatically be filled showing in grey colour.

Other clients not with us can select whichever depository they have in addition with DPID & Beneficary ID. For payment purpose you need to enter your UPIID.

7. While placing the bids, only quantity that is a multiple of the lot size is allowed.

If you wish to apply at the cut-off price, simply click on the cut-off price and select true or false.

If you want to place a bid at a different price, you can do so by entering a price in the ‘Price’ field.

Once you’ve completed all these steps, click on the checkbox to confirm that you have read the RHP and other documents and click on submit.

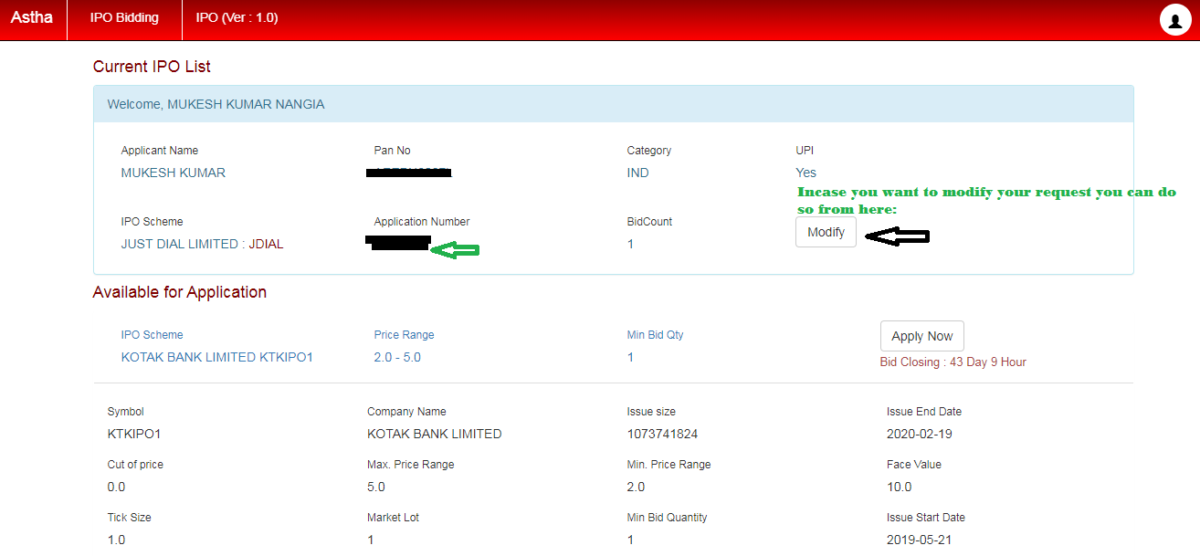

You can also modify the order on our dashboard of the portal as you can see in the image below :

How I can use UPI model for placing the IPO bid/order?

1.After necessary mobile verification in this flow and placing the IPO (online) order you need to mention your VPA (Virtual Payment Address) in Payment option.

2.On successful placement of your bid you will receive a collect request on your Bank’s Mobile app for your authentication.

3.On successful authentication the Bid amount will be mark as lien in your account by your bank (as per ASBA guidelines) and your bid will be registered with exchange.

4.On allotment of shares the amount will be debited from your account else the amount will be released.

Note – Under the ASBA process, the amount is not debited from your bank account until successful allotment. Until such allotment, the amount will remain blocked in your bank account.

How do I get a BHIM UPI ID?

Any user having a smartphone and bank account is eligible to use BHIM.

That being said, you need your mobile number registered with the bank and a debit card linked to that account.

You can download the app from Playstore or AppStore.

After installing and running the app for the first time:

- Select Language

- The app will ask permission to send SMS to verify.

- Successful attempt will take you to Home page

- If unsuccessful, after 45 seconds an OTP will be sent to you.

- If step 4 is unsuccessful, you will be prompted to dial a USSD code.

- Once NPCI recognizes your mobile number and handset, your registration is complete.

On successful registration, a default ID i.e mobilenumber@upi will be created. You can add one more VPA by going in the profile section.

Click here for a video description of the process to BHIM UPI registeration on the BHIM app.

That’s all from our end, incase if you have any suggestion or question please let us know in the comment section below. Till than “Keep Learning, Keep Earning”.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category