India’s Forex Reserve: A Comprehensive Look at its Purpose in 2023

00:00 / 00:00

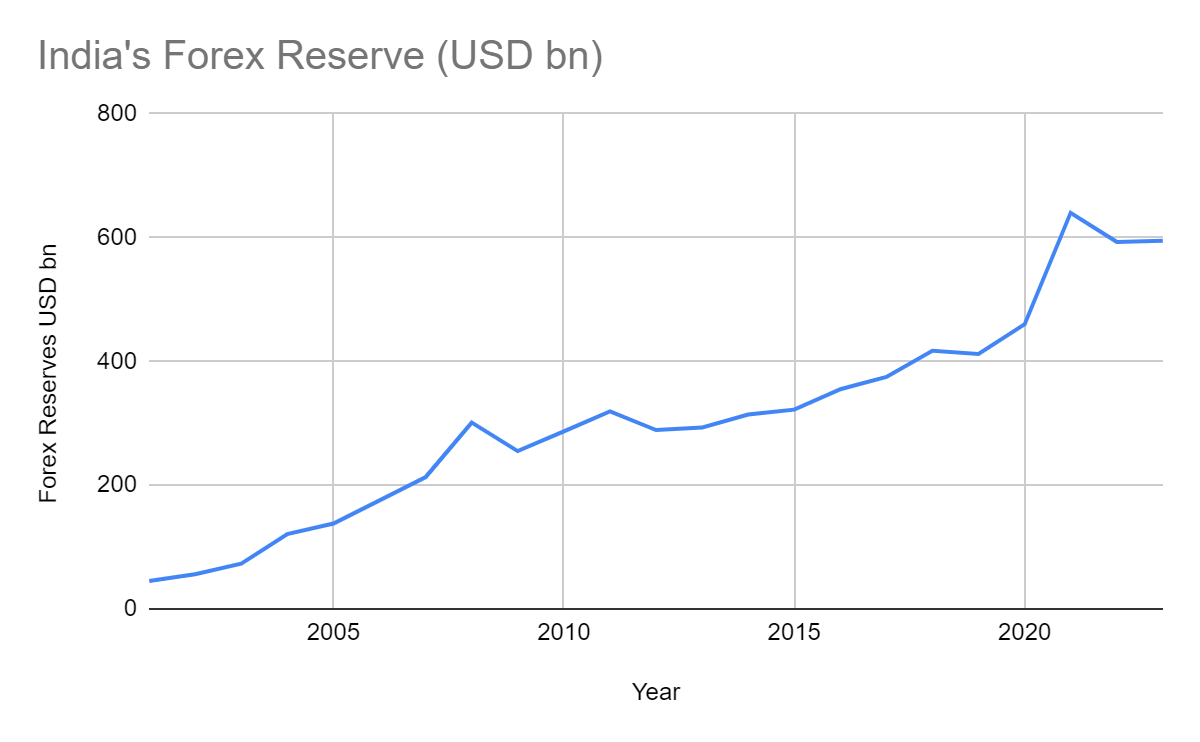

On May 5th, India’s Forex reserves went up by USD 7 billion to touch an 11 month peak of USD 596 billion, as per RBI report.

In October 2021, the forex reserves went to an all time high level of USD 645 billion, to decline from there as the regulator utilised the USD kitty to stabilise the rupee with global headwinds weakening the currency.

Let us take a look at what is forex reserve and how crucial it is for the economy.

India’s forex reserve is made up of cash holdings, bank deposits, bonds and financial assets denominated in any foreign currency, other than rupee.

Reserve Bank of India manages the forex reserve and there are four components of forex:

- FCA (Foreign Currency Asset)

- Gold

- Special Drawing Rights (SDRs)

- Reserve Tranche Position

FCA is the largest component of reserves and includes investments in overseas securities, forex held with other central banks e.g. US Treasury BIlls and deposits with overseas commercial banks.

Gold: Share of gold as part of forex reserves was 7.8% as of March 2023.

SDRs are supplementary forex reserves maintained by the IMF and represent claims to currency held by IMF member countries for which they can be claimed.

Reserve Tranche Position is mainly the difference in IMF’s holding of a country’s currency and its IMF designated quota

In India, forex reserve is mainly held in US dollar, as the main currency of exchange in international financial markets and trade centers.

What is the purpose of maintaining forex reserves?

Forex is maintained by central banks across the world to:

Stabilise domestic currency:

In economies with floating rate currency system, central banks deploy foreign currency reserves to stabilise domestic currency against US Dollar by buying or selling the currency in open market operations.

Settle international transaction:

All imports, exports and cross border transactions are done in foreign currency.

Therefore a comfortable forex cushion at all times is necessary to settle payments and uphold confidence in the economy to meet financial obligations and liabilities.

Forex reserves are utilised to tide over any balance of payment crisis.

Manage economic crisis:

A comfortable forex cushion is crucial to tide over any crisis that may hamper foreign currency inflows and maintain adequate liquidity.

For example, during a global economic crisis like recession, investors start pulling money and invest in safer havens e.g. US Dollar.

At such times, forex reserves and a strong forex position helps in retaining investors’ and market’s confidence in the strength of the economy.

The recent rise in forex kitty is a result of RBI rebuilding reserves since October 22. RBI bought USD 8 billion in the spot market in November and December.

Other than these measures, falling US yields have contributed to reserves.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.