Make the Right Move: A Comprehensive Guide to the Affle India IPO

00:00 / 00:00

Overview

The initial public offer(IPO) of Affle (India), the Indian unit of global technology company Affle India, opens on Monday.

Affle International, Singapore is the parent company of 13-year old Adtech company Affle (India) Limited .

Affle (India) is a global technology company with two business segments – the consumer platform and the enterprise platform.

Founded in 2005, Affle is a global technology company with a proprietary consumer intelligence platform that delivers consumer engagements, acquisitions and transactions through relevant Mobile Advertising.

The platform aims to enhance returns on marketing investment through contextual mobile ads and also by reducing digital ad fraud.

On Friday, Affle (India) raised about Rs 206.55 crore from 15 anchor investors by allotting 2772,483 equity shares at a price of Rs 745.

Among the 15 anchor investors, Abeerden Asian Smaller Companies Investment and Franklin Templeton Investment Funds has subscribed over 3.05 lakh shares each.

Company History

Company was incorporated as ‘Tejus Securities Private Limited’ under the Companies Act, 1956, with a certificate of incorporation.

Issued by the Registrar of Companies, Maharashtra (“RoC”) on August 18, 1994 at Mumbai.

Subsequently, the name of Company was changed to ‘Affle (India) Private Limited’ and a fresh certificate of incorporation issued by the RoC on September 29, 2006.

Company was subsequently converted to a public limited company and the name of Company was changed to our present name.

i.e., ‘Affle (India) Limited’, and a fresh certificate of incorporation consequent upon conversion was issued by the RoC on July 13, 2018.

Promoters And Management of Affle (India)

Anuj Khanna Sohum– Anuj Khanna Sohum, aged 41 years, is the Chairman, Managing Director and Chief Executive Officer of our Company.

Affle Holdings- Affle Holdings was incorporated on July 16, 2008, under the Companies Act, Chapter 50 of Singapore with the Singapore Registrar of Companies.

Affle IPO Promoter Holding

Affle India Limited IPO Details

ICICI Securities, Nomura Financial Advisory and Securities (India) are the book-running lead managers to the offer.

Open Date: | Jul 29 2019 |

Close Date: | Jul 31 2019 |

Total Shares: | 6161073 |

Face Value: | Rs. 10 Per Equity Share |

Issue Type: | book building |

Issue Size: | 458 Cr. |

Lot Size: | 20 Shares |

Issue Price: | Rs. 740-745 Per Equity Share |

Listing At: | NSE,BSE |

Listing Date: | Aug 08 2019 |

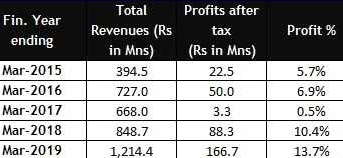

Financials of Affle India

Affle India reported net worth of Rs 72.4 crore with gross debt standing at Rs 9 crore at the end March 2019.

Its cash equivalents and other bank balances stood at Rs 30.4 crore in the same period. Its revenues have increased by 3x in the last 5 years.

They primarily earn revenue from thier Consumer Platform on a cost per converted user (“CPCU”) basis, which

comprises user conversions based on consumer acquisition and transaction models.

There consumer acquisition model focuses on acquiring new consumers for businesses.

Which is usually in the form of a targeted user downloading and opening an App or engaging with an App after seeing an advertisement delivered by us.

Also Consumer Platform’s transaction model is usually in the form of a targeted user submitting a lead acquisition form

Or purchasing a product or service after seeing an advertisement delivered by them.Consumer Platform also earns revenue through awareness and engagement type advertising

Which comprises cost per thousand impressions (“CPM”), cost per view (“CPV”) and cost per click (“CPC”) models.

For Fiscals 2019 and 2018 on an unconsolidated basis,revenue from contracts with customers was Rs. 1,177.94

million and Rs. 837.56 million, respectively, an increase of 40.6% .

Total Operating Expenses were Rs. 930.43 million and Rs. 669.91 million, respectively, an increase of 38.9% .

EBITDA was Rs. 247.51 million and Rs. 167.65 million, respectively, an increase of 47.6%.

More importantly, revenue growth in India, which is a low CPCU market, did not impact EBITDA margin on an unconsolidated basis, which was 21.0% in Fiscal 2019 and 20.0% in Fiscal 2018.

As at March 31, 2019 and 2018 on an unconsolidated basis, total assets were Rs. 935.85 million and Rs.580.31 million, respectively, an increase of 61.3%.

Company Contact Information

Affle (India) Limited

312, B-Wing, Kanakia Wallstreet,

Andheri Kurla Road,

Andheri (East), Mumbai 400 093

Phone: +91 124 4992 914

Email: compliance@affle.com

Click Here For Website Of Affle

Affle IPO Registrar

Karvy Computershare Private Limited

Karvy Registry House, 8-2-596, St. No. 1,

Banjara Hills, Hyderabad – 500 034

Andhra Pradesh, India

Phone: +91-40-23312454

Email: einward.ris@karvy.com

Website

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category