Mutual Fund Distributor Commission Structure 2026 AMFI India

00:00 / 00:00

Mutual Fund Distributors (MFDs) hold a prime place in the financial ecosystem since they are the people who use different mediums to help potential investors identify mutual fund schemes that meet their financial objectives.

In this article, we shall go into detail on various aspects, such as who mutual fund distributors are, how they charge the commission on mutual fund structures, and factors influencing their earnings.

Who is a Mutual Fund Distributor?

A Mutual Fund Distributor (MFD) is an intermediary who helps people in purchasing and selling units of mutual funds. They mainly operate under the regulatory framework of SEBI and the guidance of the Association of Mutual Funds in India(AMFI). They provide a connection between Asset Management Companies (AMCs) and investors, advising individuals on suitable funds depending on their investment objectives, risk tolerance levels and duration. But unlike fund managers, they do not directly manage any funds; the emphasis of their role is mainly on enabling transactions and offering consultancy services.

What is the Mutual Fund Distributor Commission?

Mutual fund distributors (MFDs) are paid a commission for offering their services to investors and AMCs. This amount is calculated as a percentage of the total portfolio amount or the assets under management (AUM) generated by the mutual funds.

Mutual Fund Distributor Commission Structure 2026

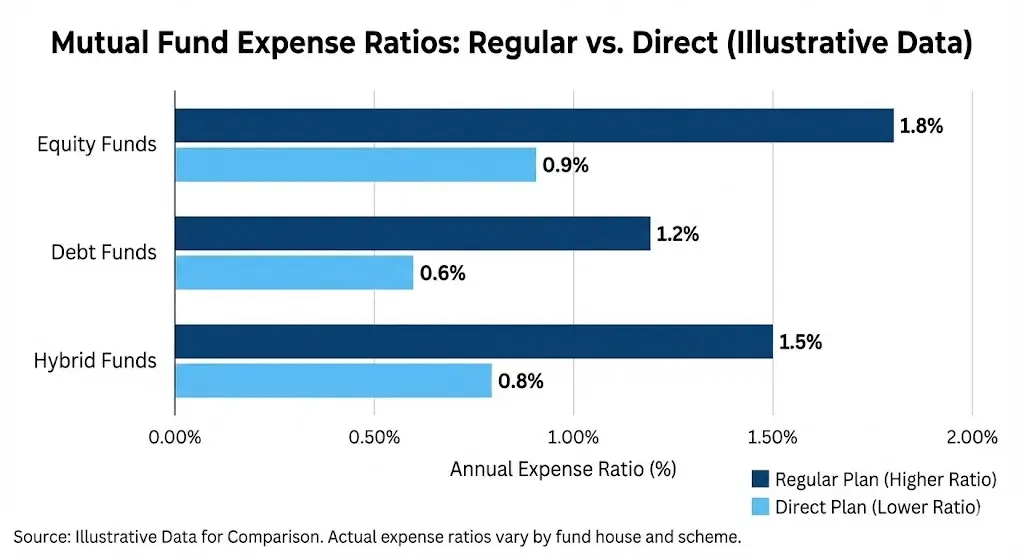

The MF commission structure for mutual fund distributors usually ranges from 0.1% to 2% of the total investment amount or assets under management (AUM) generated by the mutual funds. The structure of paying commission to MFDs varies based on the category of Mutual Fund, such as

Equity Mutual Fund: This has the potential to provide higher commission rates as the equity funds can generate higher returns in the long run.

Debt Mutual Funds: Debt funds comparatively offer lower commissions to the distributors because they generally have slow-paced movement in the market and so the income generated will also be low.

Hybrid Mutual Funds: Hybrid funds invest in a mix of equity and debt instruments, so the MF commission structure falls between that of equity and debt funds. The commission is generally moderate compared to equity funds, but higher than debt funds, as the returns from hybrid funds are a balance of both riskier equity investments and more stable debt components.

Mutual Fund Commission Chart

While investors benefit from the professional hand-holding provided by Regular plans, Mutual Fund Distributors (MFDs) require the right technological infrastructure to manage these relationships efficiently.

Platforms like Rupeezy offer a specialized suite of tools for MFDs, designed to streamline client onboarding, automate reporting, and simplify complex portfolio tracking.

For distributors looking to modernize their practice, exploring the Rupeezy Partner Program provides access to a robust digital ecosystem that supports both operational scale and client satisfaction

Types of Mutual Fund Distributor Commissions

There are two main types of commissions that Mutual Fund Distributors make:

Upfront commission

Trail commission

Upfront Commission

This is a one-time fee paid to the distributor when the investor purchases the mutual fund units initially. However, SEBI has restricted the AMC's on the payment of upfront commission to the mutual fund distributors in 2018.

Trail Commission

This is a continuous commission paid to the mutual fund agents till the time their investors stay invested in the mutual fund. This rate is generally lower, usually around 0.50% to 1.00% per annum on the Assets under Management.

Regulatory Framework for Mutual Fund Distributor Commission

The Securities and Exchange Board of India have the authority over the Mutual fund industry. They govern and regulate the mutual fund commission structure 2026 and provide guidelines on this matter. They ensure complete transparency, mandating distributors to disclose their commissions to investors. This transparency allows the investors to calculate the overall investment returns on their wealth.

Factors Affecting the Commission of Mutual Funds

Investment Class: Equity mutual funds usually provide higher commissions when compared to debt funds.

Tenure of investment: The investment tenure affects the commission, as the longer the investor stays invested, the more the mutual fund broker's commission increases.

Fund’s Performance: Mutual fund agent commission grows as the invested funds perform well, leading to more Assets under Management and vice versa.

Tips to Maximize Mutual Fund Distributor Commission

Develop a large client base: Creating a big client base will help the distributor earn higher income over the years through commissions for their investments.

Awareness programmes for Investors: Provide in-depth knowledge to the clients, so that they can know more about investing and accumulate more wealth by pooling their funds in mutual funds.

Diversify the financial products: Introduce various investment products to the clients so that people of any asset class can be converted into clients, depending on their objectives.

Encourage the clients for long-term investments: As a mutual fund distributor, his commission would depend on the time their clients stay invested.

When Do Mutual Fund Distributors Receive the Commission?

The mutual fund distributor commission rate is decided upon the agreement set by the AMC and the distributor. Generally, the commission of mutual fund distributors is disbursed monthly or quarterly. Upfront commissions in mutual funds are usually credited immediately following an investor’s initial investment; on the other hand, trail commissions in mutual funds are continuously paid as long as the investor is within the fund.

Eligibility to Become a Mutual Fund Distributor

Here is the eligibility criteria to become a mutual fund distributor in India:

Age and educational qualification: The distributor has to be at least 18 years old and also must have completed their 12th or 10th along with a 3-year diploma.

NISM Certification: The distributor candidate must pass the NISM V-A certification test, which is mandated by SEBI. They can prepare for the exam using the exam book or the NISM study material, which is freely available on the internet, and also available once they apply for the exam. Furthermore, it should be noted that the eligibility for this certification is valid for only three years, after which you will have to renew your certification.

Registration: After completing the NISM certification, they can obtain the AMFI Registration Number(ARN), which is like registration as a mutual fund distributor. The candidates who complete the registration will also be provided with an Employee Unique Identification Number(EUIN).

Empanelment with AMC’s: After getting the ARN, the distributors can approach Asset Management Companies to promote and conduct mutual fund distribution for these Asset Management Companies.

Check our article on "How to Become a Mutual Fund Distributor" to learn more.

Conclusion

In conclusion, Mutual Fund Distributors (MFDs) play a pivotal role in bridging investors and mutual funds, earning MF commissions based on their ability to guide clients effectively. With a structured commission system, regulatory oversight, and strategies to build a loyal client base, MFDs can earn substantial income while helping investors achieve their financial goals.

FAQs on Mutual Fund Commission Structure

Q1. How much commission do mutual fund distributors get in 2026?

The commission ranges from 0.1% to 2% depending on fund type, tenure, and AUM. Equity funds usually offer higher commissions compared to debt funds.

Q2. Is a mutual fund distributor profitable?

Yes, becoming a mutual fund distributor can be profitable, especially over the long term. As your client base grows and investors remain invested, trail commissions generate recurring income without needing constant new sales. However, profitability depends on knowledge, client trust, regulatory compliance, and the ability to retain long-term investors.

Q3. Is the trail commission better than the upfront commission for distributors?

Yes, the trail commission is better because it gives a regular income as long as the investor stays invested. It helps distributors earn more over time without needing new sales every time.

Q4. How can mutual fund distributors increase their commission earnings?

Mutual fund distributors can increase their commission earnings by building a large client base, promoting long-term investments, retaining clients, and diversifying the product mix offered to investors.

Q5. Is there a difference in commission rates for direct vs. regular mutual fund plans?

Yes, commissions are paid only in regular plans. Direct plans bypass distributors and offer no commission.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

100% commission sharing for one year, Rs. 0 registration fee, and earn Rs. 2 Lakhs+ per month from home.

Explore MFDAll Category