Invest Wisely: A Guide to Becoming a Successful Investor in 2025

00:00 / 00:00

Introduction

Today we will be learning about the How to be a Successful Investor in stock market?

You might have heard this line “investments are subject to market risks “mostly used for mutual funds advertisement.

However people thing the word “Risk” is equally proportional to “LOSS”. Successful investment includes one’s risk taking ability and time .

Risk is not always equals to Loss, although this may be true sometimes but not always, It can be a good reward as well.

If one wants to be a Successful Investor before investing there are certain rules you should know.

These lines tell us a lot about unique world of Investing. Many of us think its an easy job, we just need to put money in some XYZ stock & Boom.

Moreover you cannot speculate in market what will going to happen next, it requires immense research, dedication and most importanlty Patience.

Sometime you might be bored. However we know “Money is the biggest Motivation ” Continue your journey till it reaches a perfect end.

Here are the Top 5 Ways to be a Successful Investor

Research

I would like to start by sharing a quote with you & relate it to steps needed for better investing.

Vijay Kedia a well-known Investor sums up a lot by this quote. If you want to find good companies it is important to realize the power of Research.

Research can be done through knowledge. Knowledge will be gained when you are ready to learn every day. As we all know “Knowledge is Power“.

Many successful investors know that a correction in the market is a favourable time to go for bottom hunting or picking stocks with attractive valuations.

Likewise, every long-term investor knows that a bad phase in the market is the best time to accumulate stocks to create long-term wealth.

But how you will know stocks with better valuations in market ? Check this before making any decisions :

The P/E ratio , Earnings Per Share ,Price-to-Book Ratio (P/B) ,Dividends Per Share ,Operating Cash Flow , Capital Expenditures , Free Cash Flow .

As said by legendary investor warren buffett “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price”.

The amount of information available on internet is staggering.

However,to get the depth of knowledge on a topic, nothing beats a good book. Start learning and build your knowledge about market on a daily basis .

To be a Successful Investor Make a Investment Strategy

Nobody knows you better than yourself ,so instead of asking your friends ,colleagues about a stock tip invest your time in making your intellect work for you.

All you need is little bit of help. That you can do even if you spend few minutes everday in market.

To put it differently, Just by watching game of cricket one may will not become great player, he would have to play & be in the ground to understand the game.

In similar fashion Try to build your skills by learning and implementing new techniques.

Do you Remember the financial crisis of late 2008 and early 2009 when stocks dropped nearly 50%?

A better investment strategy would be Selling at the top and buying at the bottom, unfortunately that kind of market timing is nearly impossible.

However the learning from that would still work .

Let us take a most recent example – after the announcement of union budget 2019, Sensex wiped out more than 1000 points in the last two sessions.

And extending its loss from its all-time high recorded in June to over 1,500 points. Nifty 50 also faced the heat in simliar fashion.

Among BSE stocks: Tech Mahindra, Hero MotoCorp, YES Bank, Maruti Suzuki, Sun Pharma, ONGC, Tata Motors, and IndusInd Bank fell 10-30 percent .

Among Nifty stocks Major looser were IOC, Tech Mahindra, Indiabulls Housing Finance, BPCL, Hero MotoCorp, GAIL India, Coal India and YES Bank.

Check Out the Stocks Available for More than 70 percent discount in 2019 in India.

There is nothing called free lunch, meaning that if you want to increase potential returns, you have to accept more potential risk. A Successful Investor knows his risk apetite .

Market are always ready to give great opportunities for investment, it is our responsibility to grab those.

What kind of Investor Are You

There are two Kind of Investors we know generally :

Long-term Investor

Mantra for long term investing is already explained in few words in above quote . Short-term thinking is the enemy of your investments.

You can be more aggressive because you have a longer time horizon. Determining the rate of return you want ,you can choose stocks and build your portfolio.

A long term investor hold it’s position for more than 7 years sometime 10, 15 & even 20+ years.

There is a term known as Unsystematic risk .

This type of risk include dramatic events such as a strike, plunging revenues ,Higher financing cost.

Declining profit margins ,a natural disaster such as a fire, or something as simple as Management misconduct or slumping sales.

Two common sources of unsystematic risk are Business risk and Financial risk.

However non-systematic risk can be diversified, So instead of investing all your money in one company, you can choose to diversify and invest in 3-4 different companies (ideally from different sectors).

When you do so, unsystematic risk is drastically reduced.

To be a Successful Long-term Investor timing is vital. You should know about market overall nature.

Market is cyclical by nature and always recovers from drops, although it may take time to do so. when you are buying any stock make sure to do a thorough research.

While you take any position in a particular stock better to know it’s last 5 or 10 years history . Rate of return , kind of management , dividend history , peers comparision etc.

Once you have done the investment do not change your mind everyday ,track your portfolio and wait . “Patience is the key in long run “.

Short-term Investor

Short-term investments are usually sold after holding them for three years or less. Before getting into this type of investing, understand the basics of the stock market.

As the risk remains higher due to less time .

In other words be careful of single-stock purchases, and be mindful that it’s very difficult to gain higher returns than the average rate of return of the stock market.

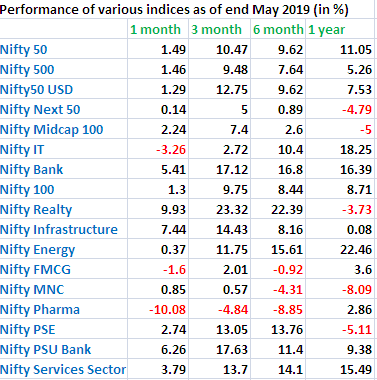

Which is in between 12-18%. Let us see return of different Nifty indexes in last 1 year.

From the above image it’s very clear ,the rate of return created by different indexes in last 1 year. Let us see returns of some stocks in short-term and long-term.

As you can see mostly returns are positive on long-term as compared to short term.

With this in mind make sure whatever kind of investor you are picking up index is much better than particular stock.

In case if you want to pick up stocks make sure it should be diversified with different sectors.

No investor can control the overall stock market, but you can be smart at how you handle your investments.

Read books or take an investment course that deals with modern financial ideas.

Handling Emotions in stock market

The reason i choose a quote for a trader instead of investor As trader will become investor by time. Emotion always ruling the minds of most investors, especially equity investors.

Handling human behaviour become hard at times. In this situation you need to ask few questions to yourself.

What are my goals? Retirement ,children education, marriage, House etc.

How much money do I need & when? When do you want these money you invested, time horizon. Avoid trying to time the equity markets, you will never succeed .

How much risk can I take? Your risk taking ability makes important changes in your investing style .

Where should I invest? This is one of the most important question, you can invest in different Mutual funds, SIP’s ,Debt fund, fixed deposits, Bonds or Equity.

We know the maximum returns are provided in equity market but one should be aware of different aspects while investing.

Your Trading Psychology

As a trader we have seen at times, we incur more losses than profit. This is what happens, you initiate a trade thinking to stick to your plan.

However that trade starts to going in loss, you wait for some time thinking it will go up . After few hours you will even remove your stop-loss as you are determined to take profit on tha trade.

At the end of trade the loss becomes huge, you will take that go home thinking its bad day for me. There is certain emotional vibratation you have created with time.

On the other hand suppose you took a trade, you started getting profit you waited few more minutes you saw its coming down & profit is getting lower.

Again it went up few points, your mind will tell you to get out of position & you will forget why you even initiated the trade .

All your plans, will remain aside and you will be happy with the small profit generated.

To avoid these situations you have to form a disciplined approach towards your trading or investing style. “Patience is the key”, don’t get overwhelmed & start agitating with the situation.

If you have done proper research, you know what you own & why you own it, then there is no need to remain in fear all the time.

“Bear in mind you are potentially your own worst enemy”.

To be a Successful Investor “Loss or profit stay in the game”

Successful investing is a journey, not a one-time event. Prepare yourself as if you were going on a long trip.

The longer you will be in game ,probability of you winning it will become high.

Even if you incur loss sometime do not get disheartened , with time new experience ,learning devlops and thats how one becomes mature .

Avoid making radical changes to your portfolio based on some big story you heard on the evening news or a hot stock tip you heard from your colleague.

Instead look for more better opportunities and how you can implement them.Keep a track of your performance & see what more you can do to increase your returns.

Your portfolio doesn’t care if you look at it every day instead spend your time with your family ,go somewhere or learn something new.

The market is hard to predict, but one thing is certain it will be volatile for sure. You mood will swing with time and events ,this is where discipline comes. At the end of the day hope for luck favour’s you.

So this were the Top 5 Ways to be a Successful Investor in my opinion, hope you have enjoyed reading it . Please let us know through your valuable comments and feedback.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category