CARG & Absolute Return: The Definitive Guide to Calculating and Understanding Returns

00:00 / 00:00

What Is CAGR (Compound Annual Growth Rate)?

Compound Annual Growth Rate (CAGR) is a (term) calculation that help’s you to know how much investment grew over a specific period of time.

CAGR can be used to measure investments of different types with one another.

Scientist of this century ,Nobel Prize winner in Physics Albert Einstein quoted once about same.

This classic statement is vital for wealth building .

Without delay let us know how much importance does it have in our life.

There are different kinds of returns that you need to be aware of, before knowing CAGR .

What is Absolute Return

As an illustration let us suppose you bought share of TCS at 1800 and sold it 1880 .

How much percentage return did you generate? Use absolute return when your time frame is for a year or lesser.

To know return in absolute terms we will use the formula below.

The formula to calculate the same is [Ending Period Value / Starting Period Value – 1]*100

=[1880/1800-1]*100

=0.044*100

=4.44%

This is return that your trade or investment has generated in absolute terms.

Compounded Annual Growth Rate (CAGR) Formula

In case you want to compare two investments CAGR helps you. Compound Annual Growth Rate takes into the account the period for which you stayed invested.

In other words you use CAGR when you want to check returns over multiple years.

If someone offers to pay you compound interest, then it primarily means that the person or the company is agreeing to pay you interest on the interest already earned.

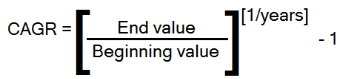

To calculate Compound Annual Growth Rate (CAGR) You must know these three numbers.

1. The investment made in the initial year (the first year of investment)

2. Value of investment at the end of the year

3. Tenure of investment.

The formula for CAGR is,

Applying this to previous TCS share (Assume you hold it for 2 years)

CAGR={[1880/1800]^(1/2)-1} = 9.08% per year

This means the investment grew at a rate of 9.08% for 2 years.

For this reason CAGR is a better measure of return over time. As a matter of fact average annual return disregards the effects of compounding.

Compound Annual Growth Rate on the other hand represents, consistent rate at which the investment would have grown if the investment had compounded at the same rate each year.

The longer you stay invested, the harder the money works for you. In simple terms compounding means the ability of money to grow when the gains of year 1 is reinvested for year 2.

Conclusion

Absolute return doesn’t take into account the rate of return over a period of time.

Absolute return value is like measuring how many kilometers you traveled while CAGR is like measuring how many kilometers per hour you traveled .

In fact most of the investment companies including mutual funds use compound interest to compute returns.

This the reason Compound Annual Growth Rate (CAGR) been called eighth wonder of the world.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category