A Comprehensive Guide to IndiaMart InterMesh IPO

00:00 / 00:00

IndiaMART InterMESH Ltd. is an leading Indian e-commerce company which provides B2C, B2B and customer to customer sales services through its web portal.

The Company started in 1996. Dinesh Agarwal and Brijesh Agrawal founded the website IndiaMART.com

A business-to-business portal to connect Indian manufacturers with buyers. The company is headquartered in Noida, India.

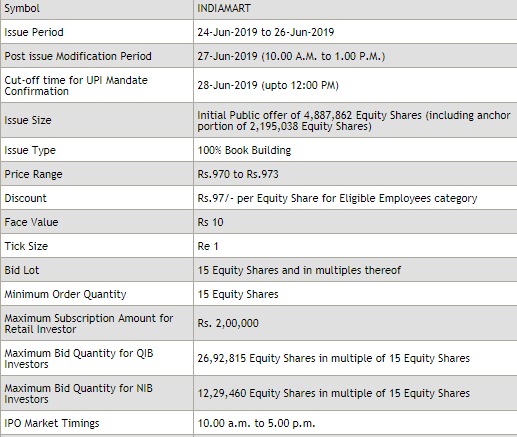

IndiaMart InterMesh is offering shares to the public through its 475 crore IPO, which opened for subscription today.

The issue would close on June 26 .

The price band of IPO is Rs.970–973 per share for the IPO, which inlcudes sale of up to 48,87,862 equity shares. Company is looking to raise up to $68 Mn .

After the IPO, Investors and promoters will decerease the stake to 52.61% from 58% earlier.

Various mutual funds like HDFC Mutual Fund, SBI Mutual Fund, ICICI Mutual Fund & Birla Mutual Fund are among the 15 anchor investors.

ICICI Securities, Edelweiss Financial Services and Jefferies India are the book running lead manager to the offer.

Promoters Dinesh Chandra Agarwal and Brijesh Kumar Agrawal will sell 14,30,109 shares through the issue, where as investors Intel Capital (Mauritius),

Amadeus IV DPF and Accion Frontier Inclusion Mauritius will offload 33,20,753 shares and 1,37,000 equity shares by other selling shareholders.

IndiaMART.com posted revenue of Rs 429 crore in 2017-18 and operating profit of Rs 46 crore.

Reviews By Broking Firm

Angel Broking – NEUTRAL view on the issue.

Geojit – Geojit is neutral on the India Mart IPO.

Choice Broking – Choice Broking has assigned Subscribe rating to the issue.

Canara Securities – It has a subscribe rating on the issue.

As of March 31, 2019, IndiaMART had 82.7 Mn registered buyers and 5.55 Mn supplier storefronts in India.

IndiaMart earns revenue primarily through the sale of subscription packages (monthly, annual and multiyear basis) to suppliers.

It also earns revenue through advertising on its desktop, mobile and app platforms.

Market Competitors for IndiaMART are JustDial and Google as they both are search engine platforms.

Private direct competitors for IndiaMART include Industry Buying, Power2SME, Moglix etc .

In June 2018 IndiaMART has filled draft papers with SEBI to raise $88.24 million through IPO and list on NSE and BSE exchange .

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category